Market With Effective Price Floor

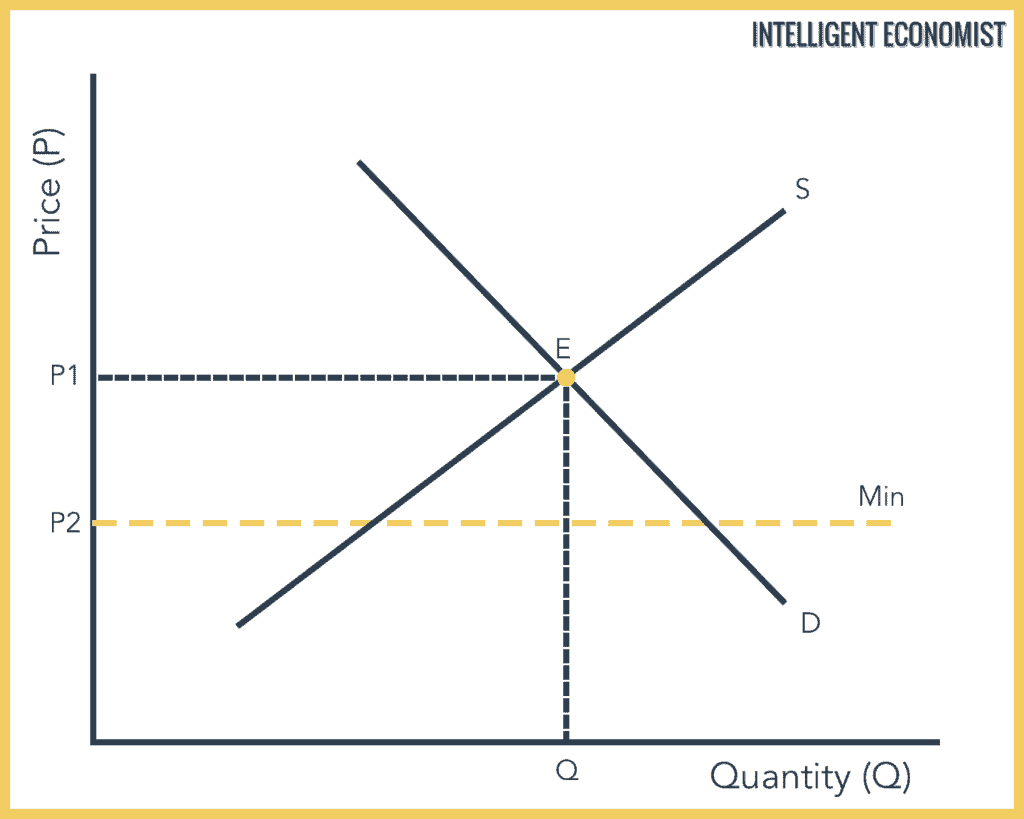

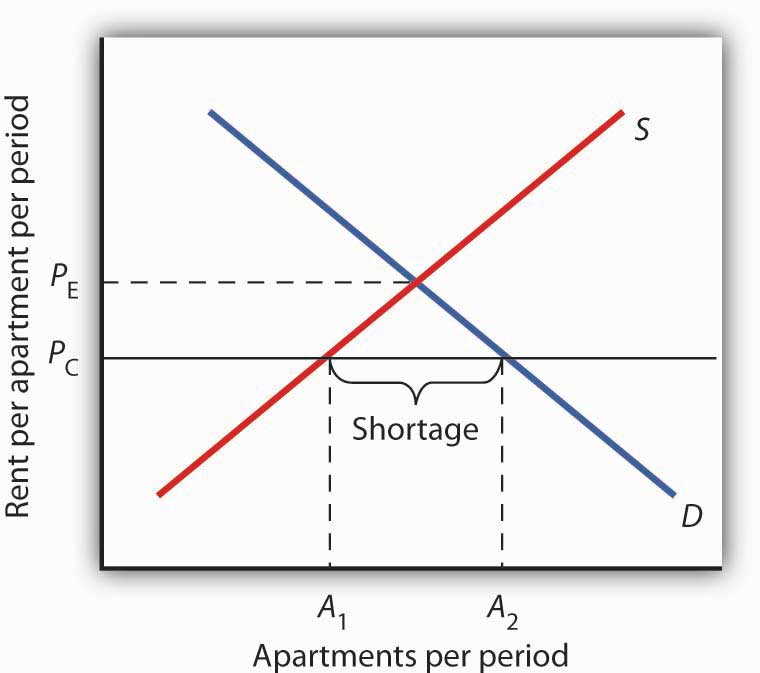

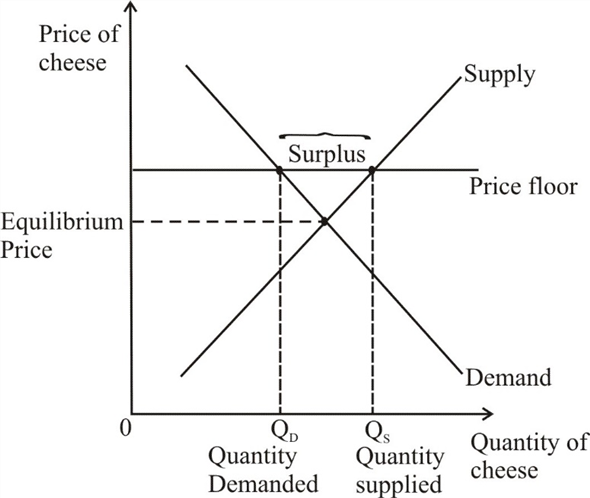

At the price set by the floor the quantity supplied exceeds the quantity demanded.

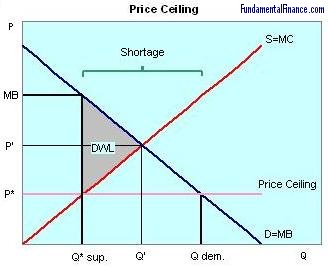

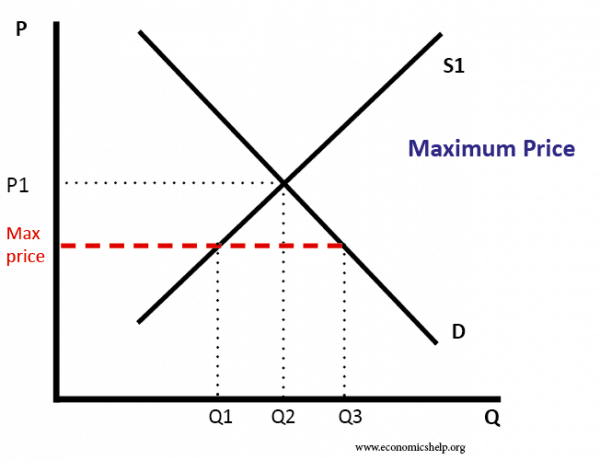

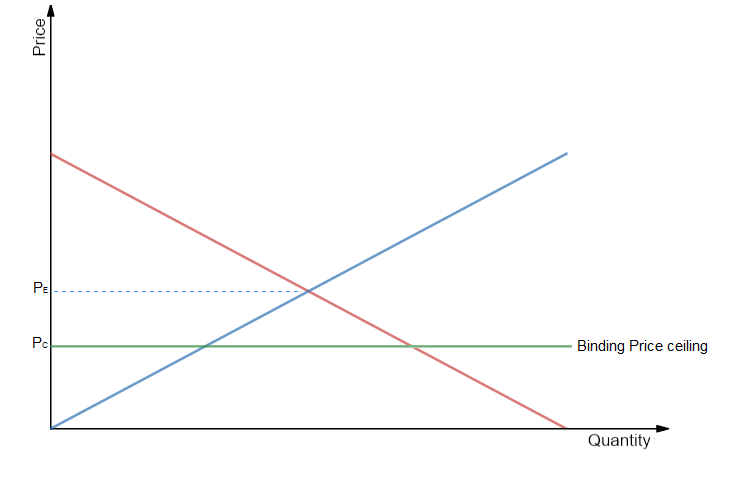

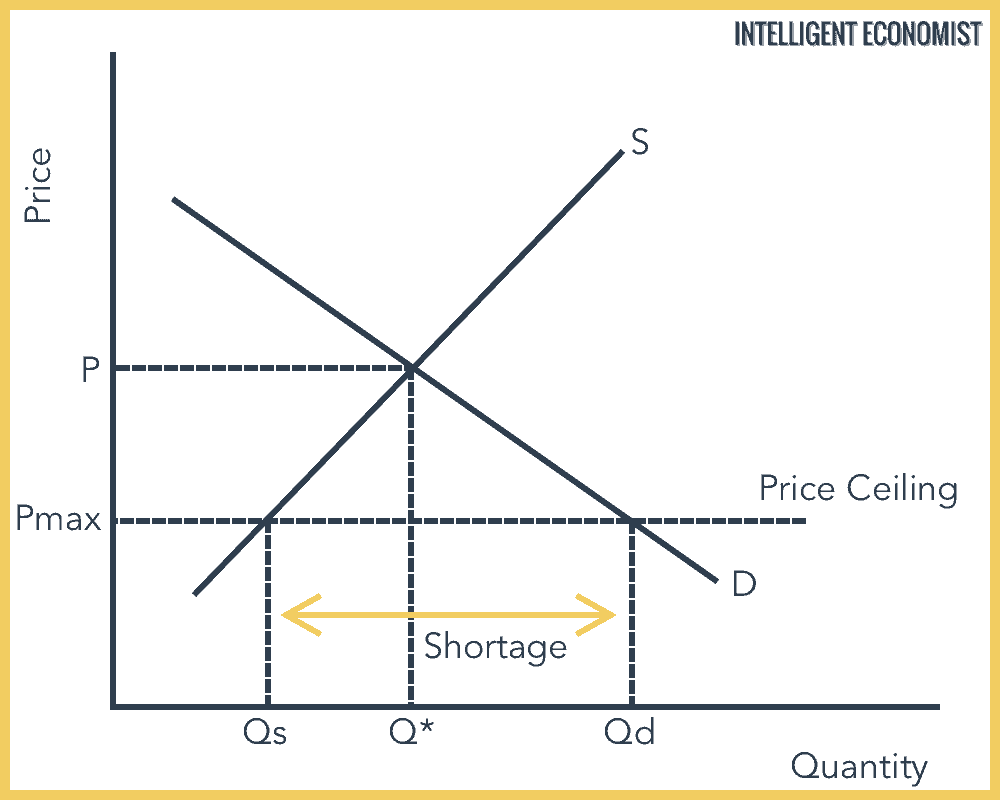

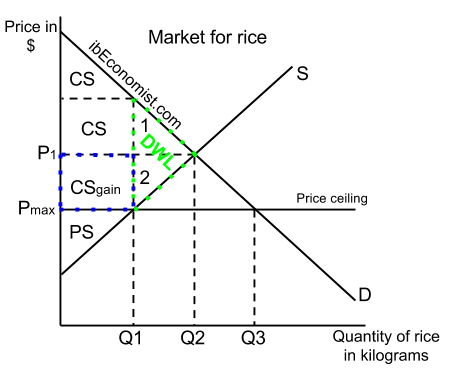

Market with effective price floor. Price floor is a situation when the price charged is more than or less than the equilibrium price determined by market forces of demand and supply. The impact of an effective price floor is generally surplus of inventory but only if the market equilibrium price falls below that floor. Drawing a price floor is simple. Effect of price floor.

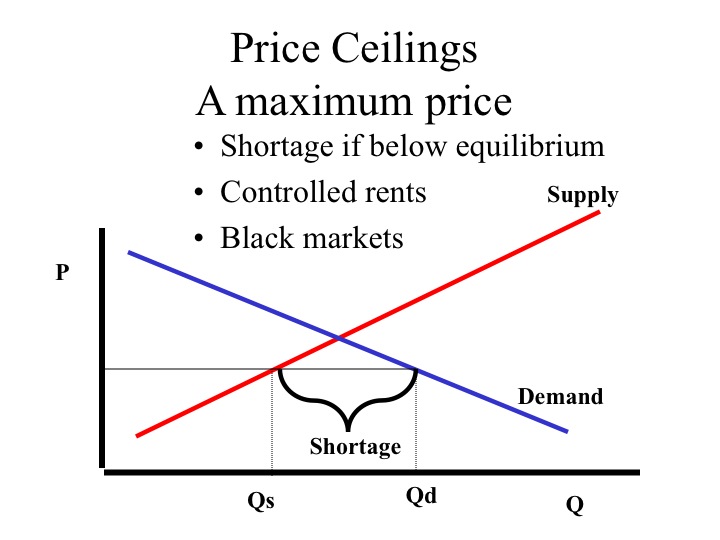

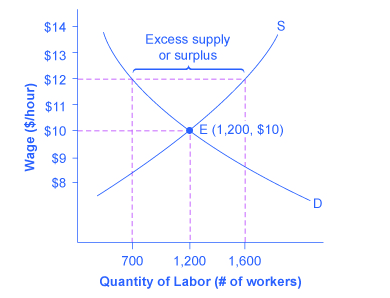

Price floor has been found to be of great importance in the labour wage market. The equilibrium price commonly called the market price is the price where economic forces such as supply and demand are balanced and in the absence of external. A price floor is a government or group imposed price control or limit on how low a price can be charged for a product good commodity or service. Government enforce price floor to oblige consumer to pay certain minimum amount to the producers.

This is the currently selected item. Market interventions and deadweight loss. How price controls reallocate surplus. Minimum wage and price floors.

Government set price floor when it believes that the producers are receiving unfair amount. A price floor acts as a safety net accessed only if the. This graph shows a price floor at 3 00. What is the impact of an effective price floor.

Simply draw a straight horizontal line at the price floor level. Perhaps the best known example of a price floor is the minimum wage which is based on the normative view that someone working full time ought to be able to afford a basic standard of living. When people feel that prices are unfairly low the government establishes a price floor above the free market. The effect of government interventions on surplus.

By observation it has been found that lower price floors are ineffective. Price ceilings and price floors. The market forces of supply and demand determine prices and equilibrium quantities but sometimes those amounts are not acceptable to society and policymakers. If it s not above equilibrium then the market won t sell below equilibrium and the price floor will be irrelevant.

However price floor has some adverse effects on the market. A price floor must be higher than the equilibrium price in order to be effective. Price floor is enforced with an only intention of assisting producers. For a price floor to be effective it must be set above the equilibrium price.

For a price floor to be effective the minimum price has to be higher than the equilibrium price. The most common example of a price floor is the minimum wage. For example many governments intervene by establishing price floors to ensure that farmers make enough money by guaranteeing a minimum price that their goods can be sold for. As with price floors interfering with the market mechanism may solve one problem but it creates many others at the same time.